In March, Yahoo was the first to report about the merging of the Federal Reserve and The US Treasury. “The Treasury, not the Fed, is buying all these securities and backstopping of loans; the Fed is acting as banker and providing financing. The Fed hired BlackRock Inc. to purchase these securities and handle the administration of the SPVs on behalf of the owner, the Treasury.”

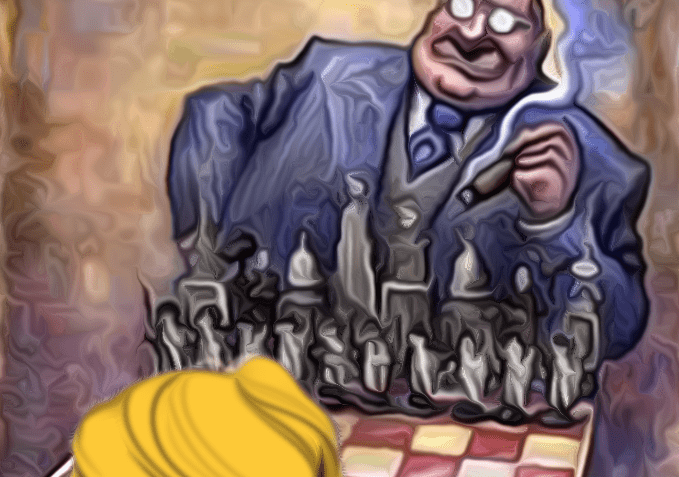

“In other words, the federal government is nationalizing large swaths of the financial markets. The Fed is providing the money to do it. BlackRock will be doing the trades. This scheme essentially merges the Fed and Treasury into one organization. So, meet your new Fed chairman, Donald J. Trump.”

Does this mean that Trump has took the power of the Federal Reserve bank away from the aristocrat bankers that has profited off America’s debt since 1913? “The U.S. Federal Reserve, under close scrutiny from president Donald Trump, has made the historic move to pump a staggering $6 trillion of liquidity into the economy since the coronavirus pandemic began” according to Forbes. “What we’re witnessing here is nothing less than the death of capitalism and birth of something new,” said Mati Greenspan, the founder of analysis and advisory firm Quantum Economics. “It’s quite fascinating, really.”

The death of capitalism? What’s so fascinating about that? Let’s dig deeper. Wallstreet Parade says, “According to the U.S. Treasury, as of February 29, 2020, there was $16.9 trillion in marketable U.S. Treasury securities outstanding. Of that amount, at the end of February, the Federal Reserve held $2.47 trillion or 14.6 percent – making it, by far, the largest single holder of U.S. Treasuries anywhere in the world.”

“By this past Friday, the Fed’s ownership of the Treasury market had increased to $3.12 trillion. It had grown by an unprecedented $650 billion in one month’s time. And on March 23, the Fed announced that it would buy unlimited amounts of both Treasury securities and agency mortgage-backed securities “to support smooth market functioning.” According to Counterpunch, The federal reserve was just nationalized, meaning, “The Federal Reserve will be picking up the tab for this bonanza, at least to start.”

So the Federal Reserve, as of March 2020, owned 14.6% of the US Treasuries (bonds) and Trump just forced them to buy up more. Not just a few billion but, unlimited. What does this mean? It appears that Trump is forcing the Federal Reserve to buy up all of the bad loans that are out there and own the debt under stocks through BlackRock’s trading. This forces the Federal Reserve to hedge for the economy and not against.

If the Federal Reserve owns more than 15% of America’s debt, it can play it safe and exit at any time, but if they owned, let’s say 50%, their decision to keep this bad investment comes into play. Owning half of the largest economy’s debt may force the Federal Reserve to either declare bankruptcy or ask to be bought out. Or, they may be forced to stop playing games with our politics and pull out their paid opposition. Either way, it’s good for Americans. And the real reason we are seeing crisis after crisis is that fact that Trump has been taking the power away from the elite for the past 3 years. The moment they shut down our economy, Trump backfired with this unprecedented move. Now you know why he was investigated, impeached, pandemic’d, rioted and possibly civil war’d. All for power.

That’s so awesome!

It sure is. He deserved much more respect than he got & Is much smarter than people think (or thought) because he’s not self-serving or cheating like many politician who chose to be opponents. He is better at what he does – a leader or ‘deal maker’ obtaining the objective for the USA in this case. You can’t figure them out – you think it makes no sense – then all of a sudden they’re right! Perception is not truth – it’s usually a lack of knowledge…especially if you believe the perceptions you’re fed.

He is awesome & won’t penalize me for driving a car that’s not electric- lol!

Thank you

He will go down in history as the greatest president in history.

The man is a genius. Never underestimate the power of Trump, genius and patriot. An incredible combination and very dangerous for elite globalists who think they have what it takes to beat him. He will have them lose at their own game. Sit back and watch the show

You people are all brainwashed. In lieu of the recent events (audiotape to GA senator) you should FINALLY see this. You people also don’t know how Washington works. Obama did the same thing in 2009. And you know why, this is done whenever there is a national emergency (recessions, pandemic), which is the actual job of the Treasury department. Therefore Trump again has done absolutely nothing. There are millions more who hate him so just because you love him doesn’t mean he should be president. Especially when the idiot is caught bribing people in his own voice to steal an election just so he can make more money.

Poor TDS clown. Get yourself ready for the next four years, (maybe EIGHT, since your Communist demonrat overlords took away his FIRST 4 w/their endless coup, that hasn’t stopped yet), of the greatest President ever, Donald J. Trump. It’s really too bad that you, (& the rest of you programmed sheep), are so blindly putting your trust in professional liars, grifters, ANTI-American Communist sell-outs. You REALLY need to turn off your tell-a-vision. Communist News Network, MSDNC, ABC, NBC, PBS, CBS, etc., etc., are all owned by SIX entities. Six that control what you think, believe, do. How’s it feel being a part of their herd? If you support the demonrats/rinos, then you are a Communist and don’t deserve to live in OUR Republic. So, stfu & WAKE up. Before it’s too late preferably.

I have been trying to find/remember the provision that would allow him another 8 years. Do you have the source? I know I’ve heard it before but for the life of me can’t find it.

Donald filed the USA corporation under bankruptcy back in March of 2020. Files and done. Then in July showed a parade of force for the people declaring a sovereign republic. The current administration is working for a defunct corporation with no credit. The media is trying to hold on as much as possible to the lie that the corporation is alive trying to impeach a president so the bankruptcy he signed is null and void.

I believe it is because he is going back to the old constitution, the Constitution for the united states for America instead of the indebted

“THE CONSTITUTION OF THE UNITED STATES OF AMERICA”.

https://fromthetrenchesworldreport.com/the-act-of-1871-the-2-constitutions-corporate-america/276232 he would be then ele

If Trump reverts back to the indebted constitution then he would be starting as the 19th President allegedly be able to do two more terms. I put in a link that explains why about the fact that our country sold us out in 1871. We are at the present time sold back to the British.

He would be serving under 2 different US Constitutions. First 4 years under a Default Corrupt CORPORATION, then 8 Years under the ORIGINAL US CONSTITUTION. Talk about a HOT POKER GOING UP DEMOCRATS ASS.

Actually he could have unlimited terms since the original constitution did not have a limit on Presidential terms.

Federalist 69. Screw this two term Bullshit. Our President can be elected as long as he has favor with We the People.

Thank you-well expressed, for the millions who stand & watch in disbelief these sheeple [sheep-people] just follow the herd & the mantra of these destroyers

FOR BLAZE. Enjoying the republic of Biden yet?!!! LOSER!!! LOLOLLL. YOU are the sheep who followed a career criminal. I’ve watched Trump (in NY) take people (idiots) like you to lunch for years. Ifsidnt need to follow MSNBC or CNN. FoxNews does nothing but spread hate and lies for ratings. And You fell for it LOSER!!!

lmao, love your projection and outright fallicious comments. Go listen to the FULL audio clip of Trump to GA Kemp, not the edited cnn fake news version. He said nothing of the sort.

I work Union, and prior to 18′ majority of us union workers hated him, now 90%+ of union works love Trump. hes done so much deregulation, we see the fake news and lies. Unions did setup for most all Trump and biden/jill events

The most that showed up to biden/Jill rallies was sub 1k, Trump had tens of thousands and millions more watching online.

Trump won election in landslide over 400 electoral votes, 80mil+ popular vote for Trump, the fraud was so obvious. Declassification has started, the truth shall shine light to darkness

If the USA, Inc. files for bankrupt will government bonds be useless, just like paper money?

The country has been bankrupted four times. You also need to research more to get to the bottom of the realities of Trump’s actions. Did you even read this complete article?

Great comment!

Obutthole was a poor quality president for all of America, he would probably be a poot quality basketball player as well.

Maybe obuttski and lamebrain Jones should come out and show america just how poor their views of the average American are

WRONG!!!!! Lololll. Loser!!!

are you serious? Did you not realize Trump knew that call was recorded and either leaked it himself or knew it would be leaked. Also, are you really that brainwashed and ignorant in the dealings of our economy, the bankers/elite who have wanted this country in debt since Lincoln that you wont see how good this was? Have you done your history on Lincoln and Kennedy and their goal to make America a debt free nation and prosperous? And both assassinated…think about that. Take your Trump deranged syndrome somewhere else or start educating yourself on the evil corruption of politics and get on the right side

And you are calling us “brainwashed”? You better read up, as you and yours will be screaming at the moon/sun real soon.

You apparently have not researched all the information to be in any position to “assume” you even have a thread of understanding as to what is actually happening!

Show us where the Fed and Treasury were merged under Obama??

You obviously didn’t listen to the entire call and are another uninformed citizen listening to msm. Trump did the merger to keep it that way and ultimately work toward a society with little to no taxes. A republic. No wars president? That’s a big deal. Now Biden wants to put us back into feuding again. He’s a dirtbag and will get what he deserves. I am tired of being a pawn for the corrupt right and left.

There are millions who hate him because they drank the kool-aid, they are sheep, they are brainwashed by fake news! For your information he stole nothing, it was the libs who stole this election and there’s plenty of evidence to that fact! Too bad there’s so much corruption in D.C. that anyone who could help prove Trump won this election, had something to hide! And if Trump needed to make more money, he wouldn’t have given his paycheck away to charities for four years!!!!!

If you understood this you would be grateful. The MSM is convincing when it is your only source of information. If you listen to the actual phone call, he is warning them not to certify a fraudulent vote count.

You are so wrong. Very few Americans know that the United States of America CORPORATION changed our ORGINAL Constitution in 1871because our country was broke after the Civil War. Jews bankers in London took all our gold and silver and Mortaged all Americans and their Property as Collateral for our debt. President Trump filed Bankruptcy on the United States of America CORPORATION in July 2020. Our national debt was DISCHARGED. THAT ACTION has brought back our ORGINAL Constitution and now we need to Elect our 19th President. Research it!

M Gray, You are correct. They do not know that your Fed income tax goes to the Rothschilds and the Vatican. Its all criminal. I Pray to God we have the courage to make this right

In order to make it right America needs to get rid of the top 10,000 left wing politicians and stand firm as conservative america.

If you haven’t figured it out yet, america is getting steamrolled by the left.

You say Obama did the same thing in 2009. I could find nothing indicating Obama made The Fed part of the The Treasury Department. Please post a link, as I would like to read about this. It seems to me like a significant change, even if all it did was force The Fed to share it’s power for the first time in its history.

“This scheme essentially merges the Fed and Treasury into one organization. So, meet your new Fed chairman, Donald J. Trump.

In 2008 when something similar was done, it was on a smaller scale. Since few understood it, the Bush and Obama administrations ceded total control of those acronym programs to then-Fed Chairman Ben Bernanke. He unwound them at the first available opportunity. But now, 12 years later, we have a much better understanding of how they work. And we have a president who has made it very clear how displeased he is that central bankers haven’t used their considerable power to force the Dow Jones Industrial Average at least 10,000 points higher, something he has complained about many times before the pandemic hit.”

https://finance.yahoo.com/news/feds-cure-risks-being-worse-110052807.html

You are sadly mistaken. The truth is coming out daily. The voting machines were connected to the internet. bags of shredded ballots were just found in the trash. Many people have been arrested for ballot harvesting and voter fraud already. Trump was disliked because he was exposing the Central Bank and the Fed for what they really are-crooks. All this covid, stolen election and human trafficing…all part of the deep state. Wake up it’s unraveling before our eyes.

You must have listened to the “Awesome” CNN version where they spliced and edited to their liking! If you actually care to hear the truth instead of words taken out of context it’s out there! But go ahead and follow CNN down the drain they won’t be around much longer because it’s not news they are reporting it opinions mixed with news!

Your comment didn’t age very well did it now that the post has admitted they made up the quotes they said came from President Trump in the call with Raffsenberger!

That’s right! They admitted they fabricated the conversation!

That’s right user above! You owe ”us people” an apology!

LOL

FUCK OFF

Found the glowfag! Go back to the farm. Your services are no longer needed, pawn.

Shut up

It’s now March…tell me again how Trump bribed someone. Just another admitted media smear. Wake up!

Where do you get your info about Trump bribing. lmao CNN?? lolololol

Wow,are you serious,I am guessing you have done no research,but are watchin the main stream media,otherwise you wouldn’t make those false statements.

Get your head out of your back door.

❤️him!

That is a fantastic objective to the US. Thank you so much for posting.

I can’t wrap my mind around this. If true, he really is a genius as I had suspected. I’m just not sure that his move was good or bad. Only God knows.

It Totally IS!!!

Thank God someone has the courage to take control of the fed. They are an out of control cartel working against the American people. Spending more than they should. We need to hold our politicians accountable for the reckless way they spend our tax dollars. When they over spend we pay through the secret tax they call inflation

The Fed is in control here, not Trump.

Wrong.

God is in control.

God Rules Ultimately

Trump is in Control, Father placed him in charge, He has grown this into way more than this now. Thank God! The other robbed and Bankrupted the USA 3 times.

That’s easy:

borrow money,

hate Trump,

be in at 10pm,

you’re set and life’s great!.

Until there’s a new rule.

Who ya gonna hate?

That would be a big wrong.

Wrong! Federal Reserve has been merged into the Treasury. All our Debt will be flushed into the FR then pushed into bankruptcy.

AGAIN… did you even read the article? The fed only has 14% interest!

Intelligence & courage. And yes. we pay for their actions in the end. That would feel a little better if we didn’t have to wonder who is really profiting from the excess being put on the taxpayers – sometimes it doesn’t seem it’s even coming back to the US in the way of higher wages, more employees, better USPS funding.. etc..

So does this mean NESARA/GESARA has been launched?

Yes it does!!! See Santa Surfing Beach Broadcast on Youtube

Keep doing what you’re doing for the AMERICAN PEOPLE President Donald Trump.

Wrong!

No! NESARA and GESARA are 100% FAKE and Bogus!

Show me more on this fake Nesara Gesara, who they are & how I can see what is or who is behind them…Thank You

NESARA and GESARA and the people that purtport and try to support it/them are in a fantasyland that does not exist and never will. Check it out folks – Jesus is a spaceman?…right, along with a whole lot of other baloney.

What President Trump is doing is something totally different.

You mean bologna…

And you’re right. It is something different. We’ll call it Trumpsera. Good day!

Yes it has.

Can everyone see now why The Main Stream Media will not tell us about this unbelievable move by Trump! It will expose all of these bogus attacks or attempts at removing our President out of office.

You’re hitting the nail on the head.

I’m surprised he hasn’t shared Kennedy’s fate, when K. considered doing something similar. I just hope this can’t be “undone”.

Trump will have to be extremely watchful if he wins. If they cannot beat him at the election, he could well be in dangerous territory.

Thus the HUGE voting sting November 3, 2020

Yes, and if these demonds succeed, Pelosy and her gang continue they will inflict bad things in our society, including the right to bear arms. If you look into War history, look up Hitler’s statements, he said in one of his sayings, ” To Conquer a Nation, You must first dissarm it’s people ” , we must fight correctively to keep this right. Our forefathers wrote this. And I believe Trump has no blood on his hands, the blood is on the hands that started the false votes, that is treason. Noticed that no one has mentioned Mr. Trump’s salery ? How he is donating all of most of it to his government while the Deamon leach Pelosy gives herself an ample raise, sad…

I think the difference is that Kennedy was unprepared and underestimated the deep state- did not know how powerful the deep state had become. Trump, on the other hand, was well aware and has been preparing for years for these moves he is making, with the backing and aid of the US Military Intelligence and others determined trustworthy. Now the deep state and the NWO cabal are finding out they underestimated Trump. I am so impressed with what I’m seeing role out and I hope and pray that he and the other patriots aiding him can SAFELY pull off this DEEP CLEANING of the deep state swamp for We the People. Incredible.

@SharonD, yes. I’m praying for the same. They need our prayers. What a great man President Donald J. Trump is! A gift from our Father. God bless him, all of the Patriots fighting to save our Republic, & protect them from the evil that they are fighting. Truly this is a spiritual war. Good vs. evil. It’s comforting to know that God wins. HE is on control. ❤

You’re so correct in your perception, Sharen D. You took the words out of my mouth.

Potus is a genius and he is working for us, “We the people”.

Trump was only an instrument. Military intelligence who had been working in the plan for a very long time, approached him to run. They wanted trump to execute the plan immediately. Being the brilliant genius he is, he said no well get them all. The approach was Trump’s idea. But he has had military intelligence behind him every step!

Ha! Yahoo “suspended commenting” on this article.

I am in the UK but have so much respect for Donald Trump for taking the deep state down , for me he is the only statesman in the world that is for ordinary people , i only hope he wins the election if not all is lost and the liberal elite will continue their plan for a new world order , god bless America and god bless Donald Trump.

I’m British too and adore Donald Trump. I believe he will be justified and win the election by a landslide.

Well much love from your family across the sea. We know you face the same, with the Rothschilds being stationed right there in London.

He did infact win by a landslide, many people love him and understand exactly what is at stake. The ones who weren’t brainwashed by the media. Luckily we have all the guns, the UN however has suggested the Small Arms Treaty and may look to enforce it more on Americans in the future. Who knows the UN may end up using the UN MP to come confiscate American firearms. If Biden is elected you can guarantee that will most likely happen, after another big shooting false flag of course. If that happens then our republic will fall.

You are right!

what does this mean for bank accounts when the fed is either bankrupt or taken over?

If that happens then we the people band together and use the very firearms they seek to confiscate, to put down their attempt of taking down America. We the people will once again rise up and do what is needed to secure freedom and Liberty and to put down the deep state/cabal/whatever name I wish to give them. We will not have anyone coming into our nation, or any domestic force, trying to destroy our way of life. If america falls the world falls and so like it or not, it is up to us to either stand up, band together, and wipe the scourge of evil off this planet, or we can choose to lay down our arms, kneel before your new gods- the NWO, and cowardly accept slavery, tyranny, and likely even death. And if we decide to surrender, then it is on us, the American people, that the entire human population becomes force vaccinated, chipped, 100% totally monitored 24/7, totally controlled under a global communist tyrannical dictatorship where 90% of the worlds population is wiped out and the 500 million or so of us left will be forced to slave away in total servitude and poverty as we are literally turned into NWO drones who’s only purpose is to serve the will of our new masters. So let me ask all of you Americans….is that the world you wish to leave behind for your children and grand children??? Do u wish to bear the weight of that future for our descendants??? Because the fate of the entire world lies directly upon our shoulders and it is up to us to either put down the NWO globalist cabal and their minions and free the world from their tyranny and then usher in a new golden age where every human being on earth is well taken care of, homelessness and poverty are eliminated and all the current systems of control are transformed into systems which will then work to provide abundance, wealth, health, and happiness for all……OR…..we can ashamedly lay down our arms, lay down and die, and allow our kids and grandkids to be forced into lifetimes of pure servitude, slavery, torture, misery, and the most hellish lifestyle one can imagine. So again I ask….WILL YOU RISE UP AND FIGHT FOR HUMANITY? OR WILL YOU LIE DOWN AND DIE AND FORCE OUR DECENDANTS INTO HELL????? The choice really is ours and like it or not, the time is now to stand up and be the hero’s the world desperately needs. This is America and America will not allow the NWO to progress any further. It’s time to put an end to all of it and free humunity once and for all. Good day everyone. And by the way, don’t worry about who’s going to sit in the White House come January 21. It’ll be trump guaranteed. I am not concerned even in the slightest. I see all the 100’s and maybe even 1000’s of seperate puzzle pieces all coming together and I see the trap that the left, the cabal, and all other deep state members blindly stumbled into head first on November 3rd, 2020. Get ready to watch the greatest show on earth as the real truth of the election and many other important things finally start to make their way to the masses. This is American Revolution 2.0 and the outcome is already determined and guaranteed. We win. Nevertheless, never let your gaurd down and be ready at a moments notice to rise up and take back your country should it come to that.

Amen, Sharon, that’s some top-shelf love right. Go get em, #WeThePeopleWorldwide

They want to impeach Trump and convict him for helping his people. Pelosy is the the one that started all this mess in the beginning with the false vote entrys, they should charge her and her followers with treason !

All this is so far over my head I can’t really understand or comprehend any of it.

But I spose the bottom line and real question I have is This is a good thing? POTUS really is lookin out for America? It’s not some overly complicated explanation of saying we’re silently getting duped??? Serious questions. Cuz I haven’t a clue what any of this garble means

Understand the Federal Reserve is a private central bank with no allegiance to the USA. It’s sole purpose is to lend money with interest to the USA government. Our economy is based on debt to the Federal Reserve. These bankers with no allegiance to the USA force the government to pander to their agendas through raising and lowering the interest rates which effects how much we can buy for a dollar.

Somehow Trump has forced the Federal Reserve to take on so much debt, it is in the Federal Reserve’s best interest to keep the interest rates low increasing how much we can buy for a dollar. At the same time he has somehow merged the Federal Reserve into the Treasury headed by Secretary Mnuchin, so in effect President Trump has control of the Federal Reserve.

Speculation is, and it is only speculation (guesses), Trump will leave the Federal Reserve holding the trillions in debt for causing depressions and recessions which ultimately stole the wealth of the American peoples. This would wipe out our debts which businesses and individual taxpayers are taxed to pay off. Some speculate the deferral and ultimately the removal of the payroll tax is a first step towards the goal of a tax free citizenry.

I don’t understand the removal of payroll tax. I asked my boss if she had heard of it and she said she didn’t know about it. Who does it affect and how?

Thank you. your description of the merge. You made it simple and very clear. It’s exactly what I and others needed for clarity on this extraordinary transfer.

Any updates or ideas about the aftermath of Trump ending the Fed? How do you think it will affect everyday citizens with mortgages, car loans etc..?

Too soon to tell. Right now, we need to drain the swamp after all this voter fraud to then start working on Nesara/Gesara rules.

Admin Man I have something to contribute to your site a series of Visions that should bolster the resolve of al true patriots in this fight against tyranny. In The spring of 2014 I was out at a lake in Blue Springs Missouri praying when I saw a vision of something you posted here 5 years before Trump did it. As I sat in my jeep praying the Lord said to me what do you see son. I said I see 2 fat owls sitting on a power line, then He said now what do you see, then I saw words appear. One owl on the left was marked US Treasury and 1 on right was marked Federal Reserve Bank, then I saw the 1 marked US Treasury lean over and slurp up the owl marked Federal Reserve Bank. That happened in March of 2019 5 years later. I have many more visions I would like to share and words to prove that Trump will rise like Lazarus from the Dead. I was taken up to heaven recently and saw an amazing show of what is to come, before that the Lord said get a bowl of popcorn. It was Jan 18th and the next day after that amazing vision and words I found out was National Popcorn day. Can I write an article for this site that you can publish and explain more?

Absolutely and you can write for my new group Above Top Secret. Email me: ehygienics@mail.com

Little wonder George Soros is spending BILLIONS to to block Trump from another 4 years. Maybe it’s payback time.

Gitmo is getting readied for those once elite politicians who thought they were above the law and prosecution from high crimes against the people of America. God Bless President Donald Trump. For Such A Time As This.

George can`t spend his billions fast enough to stop what is about to happen to him and the once powerful, and elite of this world.

Great job President Trump. When will the left realize they can’t out smart President Trump he’s a great businessman, and at least always 5 steps ahead of his opponents

He has been outsmarted. LOSERS!! You people need to get outside more and stop listening to opinion pieces for news. They’re spreading lies for ratings.

Fear not the lowly evil Rockefeller schemers:

http://stateofthenation.co/?p=8136

https://aim4truth.org/2020/02/28/coronavirus-qinetiq-and-the-rothschild-bombshell/

It is about British/J..wish Promoters of fascist imperialism on behalf of EVIL Tycoon John D. Rockefeller, the extent of his evil exposed by

@JFKjrQ article at http://t.me/QVids

Where is the evidence that Trump took over the Fed. Res. Bank? The links put on here do not show anything, no evidence of this.

Exactly!! They will believe anything…anyone says Trump has done nothing but line his pockets with their money!!

An essential ingredient of “successful” capitalism requires continuous market expansion and exploitation of second and third world countries. The Rockefeller’s understood this concept more than anyone and steps were taken to take over and harness the CIA into a projected force of a “field operative(s)” cabal that would ply the black arts of murder, corruption, blackmail and extortion thus paving the way for groundbreaking investment into new markets abroad aka, slave labor and extraction enterprises in poor countries. This subversion of an intelligence and information gathering agency (Truman’s original intention) into what the CIA is today, signaled what transnational corporate policy would be…that is, to offer the “collateral” found within the the black arts as a means to insure returns on monies invested by stock holders Now., the mask of these capitalists have been torn off. In response, a whole new global paradigm is coming into focus that will guarantee privileges for a vast pool of human indentured servitude, creating contractual time lines for labor services rendered done with dignity, union worker fellowship, a new creation, not unlike the IWW but also having greater influence and representation at the UN, BRIC, SCO and corporate conventions such as the Bilderberg Group.

Stop lying. All of this. Verifiable lies – if only commenters would care enough to check. Invalidating your misunderstanding is part of learning.

Sincerely,

the voice in your head that suspects Trump really is another idiot charlatan (sorry, I’m right, but you already knew that)

Our one true Father is in complete control. Took me quite awhile to really get this. Praise God for all things..

But the question is, Did He Get It Done? Did Trump bankrupt the FED, and force the USA Corporation into insolvency? It’s the only thing which can force Washington DC to un-incorporate, thus un-incorporate the USA.

That is the greatest news ever in the history of this beautiful country

A common jibe on social media is “this didn’t age well”

Well Mr. Carner, lemme tell ya, this piece of yours has aged remarkably well, the kind of aging considered with fine wine or a Stradivarius.

You’ve nailed the very reason we were plandemic’d in the first place – Trump was already taking them apart, piece by piece.

Those efforts have only sped up since his “election loss” – oh the brilliance of this current POTUS (yes, Trump is still POTUS.) In the coming days, weeks, and months, he’ll complete the job, right down to a Nuremberg Trial sequel.

b-b-b-aby, you just ain’t seen nuthin yet.